Massive Solana short by whale: Will SOL crash further?

A whale opens a $4M short on Solana (SOL). Will the $75 support hold? Technical analysis and price predictions for SOL's future. Click to learn more!

A whale opens a $4M short on Solana (SOL). Will the $75 support hold? Technical analysis and price predictions for SOL's future. Click to learn more!

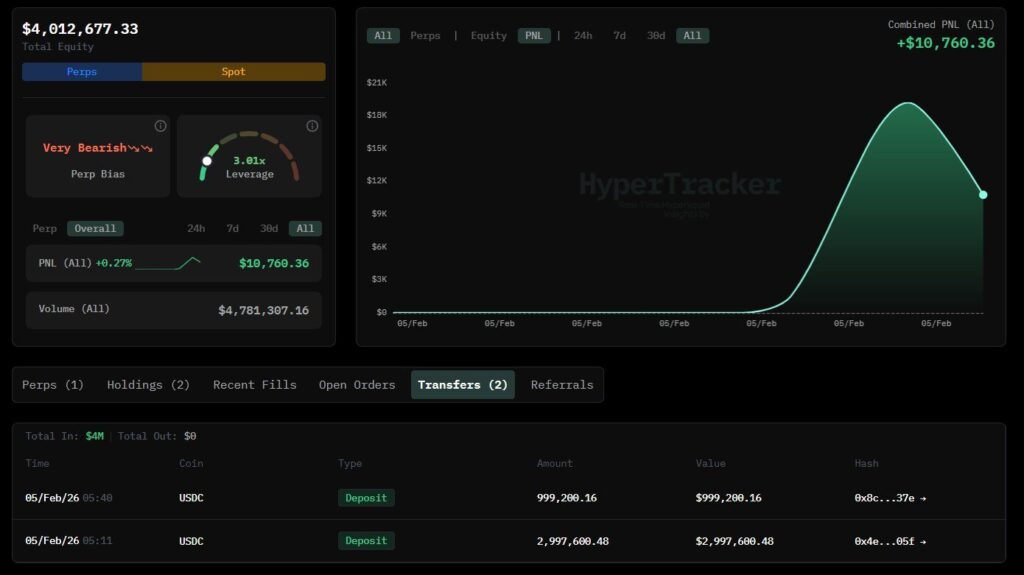

This operation hasn’t gone unnoticed. A newly created wallet deposited $4 million in USDC on Hyperliquid before immediately opening a short position on Solana with 3x leverage. Unlike typical hedging strategies, this move reflects a pure bearish conviction (naked short).

The use of moderate leverage (3x) suggests this trader isn’t looking for a quick gamble, but rather anticipates a sustained bearish trend without fearing immediate liquidation. This positioning comes as the broader market shows signs of weakness, creating an asymmetry where a few large players absorb downside risk while a crowd of smaller holders still hope for a rebound.

Currently, Solana (SOL) price is under intense pressure. Indeed, SOL dropped as low as $67 overnight, breaking its previous low of $78. Currently at $79, SOL is attempting a rebound. However, the inability to maintain above this level should extend the decline.

From a technical perspective, Solana remains trapped within a well-defined descending channel on the daily chart. The market structure is clearly bearish, marked by progressively lower highs and lows.

The recent rejection around the $120 zone, which corresponded to horizontal resistance and the channel’s midpoint, was the catalyst for this new leg down. The buyers’ inability to defend the psychological level of $100 reinforced sellers’ control.

Momentum indicators are flashing red:

If the current zone doesn’t trigger a technical rebound (dead cat bounce), the next major target identified by the analysis sits at the historical support level of $80. Given the current price (already below $80 on some exchanges), the risk of a slide toward lower levels becomes tangible.

The scenario is tense for bulls. To invalidate this bearish thesis, Solana would need to consolidate above $80 and reclaim $100.

Conversely, if the $80 support definitively breaks on a weekly close, the door would open toward liquidity zones unexplored for several months. SOL could fall back to $54 or even between $20 and $30 in the coming months as capitulation could worsen.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.