$26 Billion in Bitcoin Deposited on Binance: What’s Going On?

Binance records $26 billion in inflows of young Bitcoin in October, signaling intense speculative activity in the market.

Binance records $26 billion in inflows of young Bitcoin in October, signaling intense speculative activity in the market.

The market has just endured one of the most tense weeks of the year. Bitcoin briefly plunged below $100,000 on Tuesday, triggering a cascade of liquidations on leveraged positions and sending fear indicators skyrocketing. Over-exposed traders were wiped out, and bearish sentiment spread like wildfire across social media and specialized forums.

Yet, BTC quickly recovered this critical psychological level, proving that demand remains solid around major support zones. This resilience testifies to the persistent appetite of institutional and retail buyers near $98,000-$100,000, despite the violent correction.

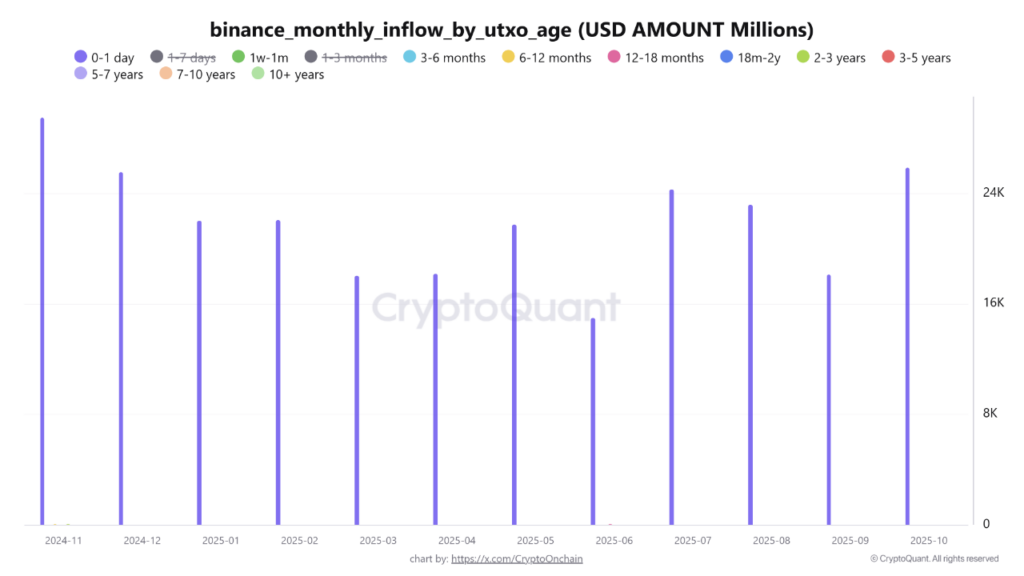

But on-chain analysis reveals a concerning phenomenon that might explain this increased volatility. According to CryptoQuant data shared by CryptoOnchain, Bitcoin inflows to Binance literally exploded in October 2025. And the nature of these movements deserves our full attention.

The figures speak volumes. Inflows of “young” Bitcoins to Binance jumped from about $18 billion in September to nearly $26 billion in October. This 44% increase represents one of the most significant monthly spikes observed over the past twelve months.

When we talk about “young” Bitcoins, we’re referring to UTXOs aged 0 to 1 day. These recently moved transaction units indicate very short-term trading activity, typical of day traders, arbitrage algorithms, and speculators looking to capitalize on intraday fluctuations.

This concentration of hot money on Binance, the world’s largest exchange platform in terms of volume, mechanically amplifies volatility. High-frequency traders and market-making bots create rapid and sometimes brutal price movements, without necessarily reflecting a fundamental change in Bitcoin’s valuation.

Historically, massive inflows to exchanges often precede episodes of selling pressure. Investors move their assets to platforms to take profits, cover positions, or react to macroeconomic catalysts. However, the current market structure suggests a more complex dynamic than a simple bearish movement.

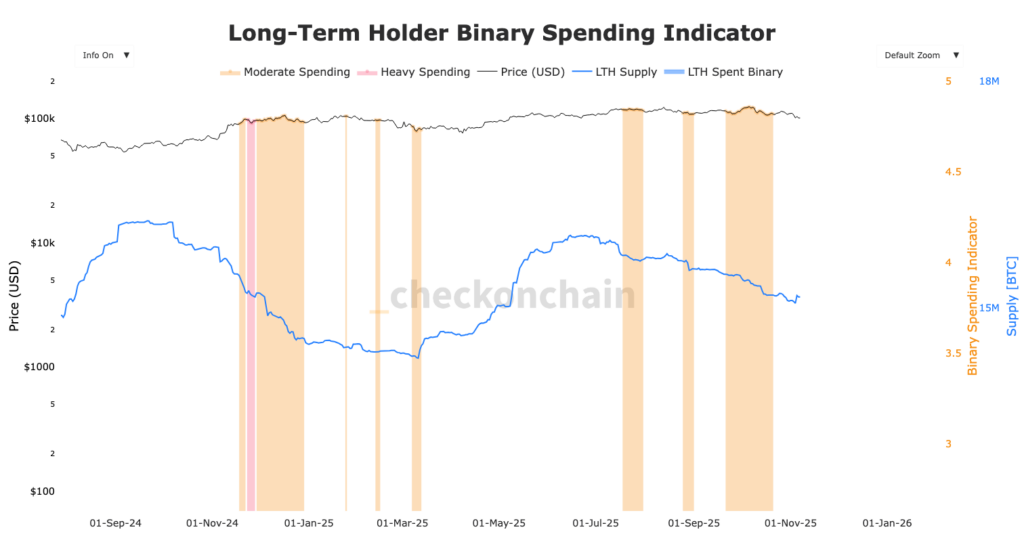

The most reassuring point in this on-chain analysis concerns the behavior of long-term holders, commonly called LTH in the crypto lexicon. The data shows that inflows of “old” Bitcoins to Binance remain virtually non-existent, close to zero over the same period.

This divergence between young and old coins is fundamental to understanding the market structure. It indicates that conviction investors, those who accumulate and hold their BTC over periods of several months or years, are not participating in the current selling. They maintain their positions in cold storage or on non-custodial wallets, away from exchanges.

This behavior reveals a two-speed market. On one side, speculative capital generates noise and short-term volatility on trading platforms. On the other, the solid base of convinced investors remains firmly anchored, preserving Bitcoin’s structural fundamentals.

This dichotomy is not uncommon in consolidation phases after strong rallies. With BTC having more than doubled since its last major low, it’s natural for part of the market to take profits while another accumulates or holds in anticipation of new highs. The question remains which camp will prevail in the coming weeks.

While the market violently purges speculative altcoins, Bitcoin consolidates its status as the ultimate store of value. Meanwhile, Pionex bots transform each oscillation into mechanical profit, without emotion and without fees.

Here’s how to benefit right now

On the technical front, Bitcoin is evolving in a fragile configuration. The 4-hour chart shows a modest bounce from the low at $98,900, but the price is struggling to regain traction above $103,000.

The 20 and 50-period moving averages are beginning to tilt downward, confirming a bearish short-term trend. These indicators, widely followed by algorithmic traders, now act as dynamic resistance and limit bullish recovery attempts.

The critical zone to watch is between $105,000 and $107,000. A clean break above this range would likely trigger short squeezes and signal a return of confidence. Conversely, rejection at these levels could trigger a new wave of selling, with potential retests of $100,000 or even $97,500, a major psychological support.

Volume remains high, indicating that uncertainty still dominates sentiment. Derivatives markets display predominantly bearish sentiment, with long/short ratios unfavorable to bulls. For momentum to truly change, BTC will need to not only reclaim its key moving averages but also sustain itself above $107,000. Until proven otherwise, caution remains the watchword.

Furthermore, as trader Killa points out, “violent” selling pressure was observed on the Order Book in recent days. This explains the difficulty in breaking through $104,700. Caution will therefore be necessary if Bitcoin approaches $100,000 again.

On the same topic:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.