Why Bitcoin Could Plunge to $87,000: ETF Outflows and Options Expiry Loom

Bitcoin faces pressure as ETF outflows hit and billions in options contracts expire. Could the price fall to $87,000? Find out the key factors.

Bitcoin faces pressure as ETF outflows hit and billions in options contracts expire. Could the price fall to $87,000? Find out the key factors.

The crypto market is holding its breath. After a promising start to the year, the wind has turned with unexpected violence. In just two days (January 6 and 7), the Spot Bitcoin ETFs recorded cumulative net outflows of $729 million. This massive movement of institutional capital immediately impacted market sentiment, causing the fear and greed index to shift from a “neutral” level to “fear”.

Currently, Bitcoin is trading around $91,000 (down approximately 1% over 24 hours), struggling not to yield under selling pressure. A striking fact highlighted by analysts is the growing correlation with Asian markets: BTC tends to climb during Asian sessions only to suffer brutal sell-offs as soon as US markets open, coinciding with ETF outflows.

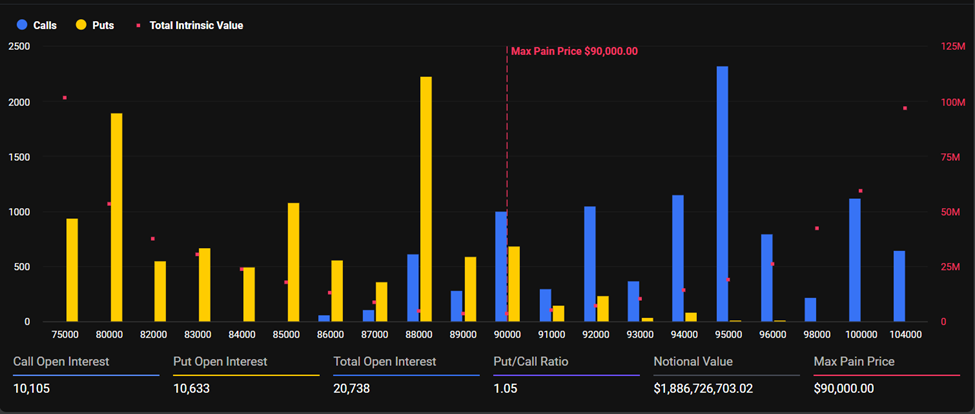

This Friday marks a major deadline for derivatives products. At 8:00 AM UTC, more than $2.2 billion in options contracts are set to expire. The phenomenon is visible to the naked eye on the charts: Bitcoin’s price seems magnetically drawn around $90,000, while Ethereum struggles around $3,100.

This is the classic “Max Pain” effect. It’s the price level where the majority of options (both Calls and Puts) expire worthless, maximizing profits for market makers at the expense of retail traders. Currently, Bitcoin’s Put/Call ratio stands at 1.05, signaling extreme caution and massive hedging by investors fearing a drop below key support levels.

For Ethereum, the dynamic is slightly different. With a Put/Call ratio of 0.89, sentiment remains moderately bullish. Traders appear to be betting on a faster recovery for ETH once this technical lock is broken, hoping to see the asset break free from the $3,100 resistance to restart the engine.

Graphically, Bitcoin is walking a tightrope. The correction from the local peak of $94,700 has brought the price back to a major psychological and technical threshold. The $90,000 level is currently acting as the last line of defense before a more serious deterioration of the trend.

The key indicator to watch is the 50-day Moving Average (MA50), positioned precisely at $89,200. This is the line bulls cannot afford to lose:

Despite this grim short-term picture, on-chain data offers a glimmer of hope for patient investors. Selling pressure, materialized by profit-taking (Realized Profit), has significantly decreased compared to the end of last year, dropping from over a billion dollars per day to approximately $183 million. This consolidation above $80,000 could be healthy for building a solid base. And the $100,000 target remains more than probable.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.