Ethereum Nears Crucial $4,000 Level : What Does the Future Hold ?

Ethereum (ETH) surges 27% to $4,000, backed by strong accumulation, challenging resistance levels. Will it correct or set a new record ? Explore the analysis now !

Ethereum (ETH) surges 27% to $4,000, backed by strong accumulation, challenging resistance levels. Will it correct or set a new record ? Explore the analysis now !

Ethereum has crossed a symbolic threshold, coming within 7% of the psychological $4,000 barrier. This remarkable 27% surge in just one week raises numerous questions about what happens next. What are the key signals to monitor in order to anticipate the next move for the second-largest cryptocurrency ?

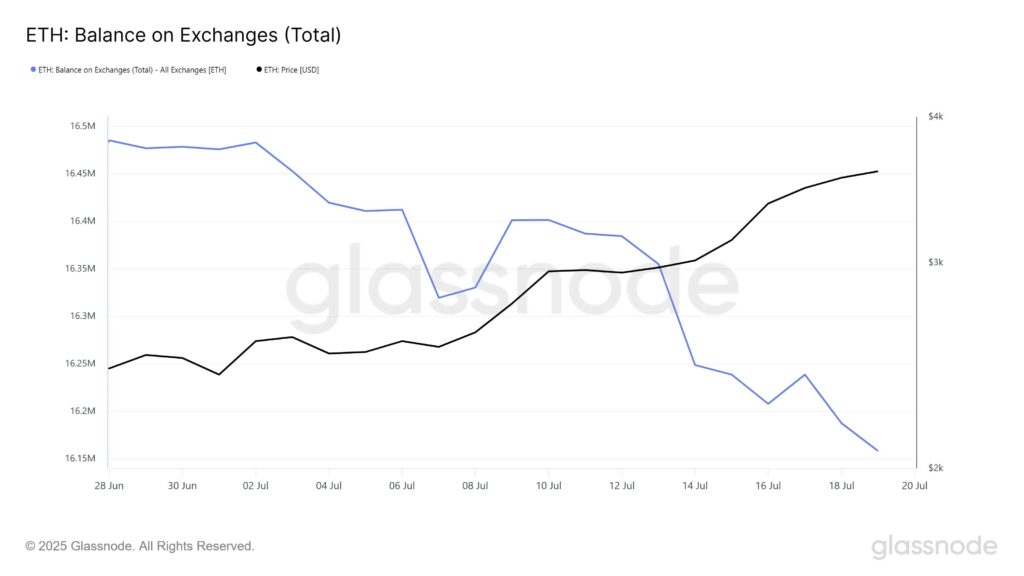

Since early July, the Ethereum balance held on exchanges has plummeted by more than 317,000 ETH, equivalent to over $1.18 billion. This dramatic decline reflects investors’ confidence in continued price appreciation. Demand significantly exceeds available supply, mechanically boosting ETH’s valuation.

Some market participants are even betting on an imminent breach of the $4,000 psychological threshold, adding further bullish pressure. However, this level has historically acted as a strong resistance zone, likely to trigger massive profit-taking.

Ethereum’s NUPL (Net Unrealized Profit/Loss) indicator is currently approaching the “belief-denial” zone. This ratio signals whether investors are generally in a state of unrealized gains or losses. Notably, every time ETH has entered this zone in the past, a short-term correction has followed.

This level often acts as a saturation point where the most optimistic investors seek to secure their profits. Breaking through $4,000 could therefore trigger a significant wave of selling, temporarily challenging the bullish trend.

The Fibonacci Bollinger Bands indicate a potential peak around $4,480 within 3 days. Indeed, although profit-taking might slow its rise in the coming weeks, ETH should nevertheless manage to break through the $4,111 resistance.

This strong historical resistance hasn’t been breached since December 2021. It’s therefore the perfect opportunity for ETH whales to liquidate their holdings and the shorts positioned just above. This confluence increases the probability of ETH’s continued bullish momentum beyond $4,100 in the coming weeks.

Nevertheless, between $4,200 and $4,500, caution will be necessary due to correction risks.

In this context, Ethereum’s future will essentially depend on investors’ continued appetite for ETH. If accumulation persists, a decisive break above $4,500 would pave the way to new all-time highs. But beware of correction risks in case of massive profit-taking, which could push prices back toward $3,500 or even $3,000.

Here’s a simplified guide to obtaining the token on Bitget :

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.