Midnight Blockchain launching in March: Will ADA and NIGHT tokens surge?

Midnight blockchain launching in March! Will ADA and NIGHT tokens see a price surge? Get the latest analysis and predictions.

Midnight blockchain launching in March! Will ADA and NIGHT tokens see a price surge? Get the latest analysis and predictions.

The suspense is coming to an end. Charles Hoskinson, founder of Input Output Global (IOG), took advantage of a recent appearance to officially announce the launch window: Midnight will go live at the end of March 2026. Long teased under the code name of a data protection-focused project, Midnight isn’t just a simple sidechain; it’s a true partner chain designed to operate in complete synergy with Cardano.

Midnight’s value proposition is unique in the current crypto landscape. Unlike traditional “privacy coins” like Monero that mask everything by default, Midnight uses Zero-Knowledge (ZK) technology to offer programmable privacy. The goal? Enable businesses and individuals to protect their sensitive data while remaining compliant with financial regulations (KYC/AML). It’s a delicate balance that Hoskinson often calls the “Holy Grail” of blockchain.

Technically, this architecture allows you to prove that you have the necessary funds or identity for a transaction, without ever revealing who you are or the exact amount, except to competent authorities if necessary. An approach that could appeal to institutions, often reluctant to expose their ledgers on a transparent public blockchain.

Midnight’s arrival isn’t just a technical feat, it’s a major economic event for ADA holders. As a partner chain, Midnight should leverage Cardano’s security and liquidity. The consensus model provides that Cardano’s Stake Pool Operators (SPOs) will be able to secure Midnight, thus generating new revenue streams.

Moreover, the question of Midnight’s native token, DUST, is on everyone’s lips. While final details of the distribution (airdrop or claim for ADA stakers) remain to be clarified in the coming weeks, speculation is running high. Historically, this type of announcement creates buying pressure, with investors looking to accumulate ADA to maximize their eligibility for future rewards.

If the deployment proceeds without technical hiccups – no congestion, no critical smart contract bugs – this will validate IOG’s scaling strategy. In a market where the “Layer 1” narrative is ultra-competitive, Cardano needs this kind of success to maintain its position against competitors like Solana or Ethereum.

The impact on ADA’s price could be significant. Currently, the crypto market is showing signs of recovery, and news of this magnitude is typically the kind of fundamental news capable of triggering a breakout. If volumes follow, ADA could attempt to test its former resistance zones.

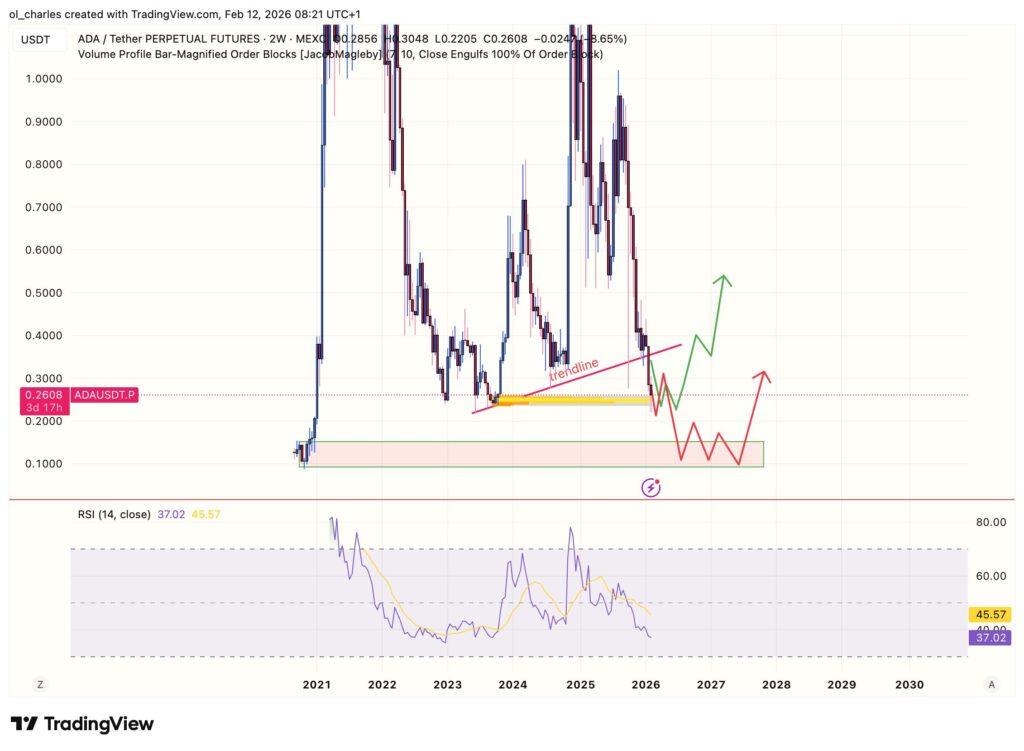

Currently, ADA has managed to maintain itself above its 2-week order block at $0.24. This is a massive demand zone that should serve as a bottom for ADA. Nevertheless, the risk of a downward break remains present. In which case ADA could return to the $0.15 zone.

The key will lie in Midnight’s actual adoption post-launch. If major dApps migrate or launch immediately on this new chain, the bullish trend could transform into a sustainable movement, propelling ADA above $0.4, which would restart the long-term bullish trend. The coming weeks will be decisive in confirming whether whales are starting to accumulate in anticipation of this event.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.