SPX Keeps Surging : How Far Can the Memecoin Price Go ?

SPX6900 skyrockets by 23% to $1.85, overshadowing memecoins with a record volume. Will it hit $100 billion during this bull run ?

SPX6900 skyrockets by 23% to $1.85, overshadowing memecoins with a record volume. Will it hit $100 billion during this bull run ?

After a 23% surge, the memecoin SPX has established a new all-time high, highlighting the strength of the memecoin rally. Although the market shows signs of short-term overheating, the long-term bullish momentum remains solid.

Massive accumulation in the spot market and liquidity injections in derivatives have fueled this explosive rise. While a short-term correction is possible, technical indicators suggest that the long-term bullish potential remains intact.

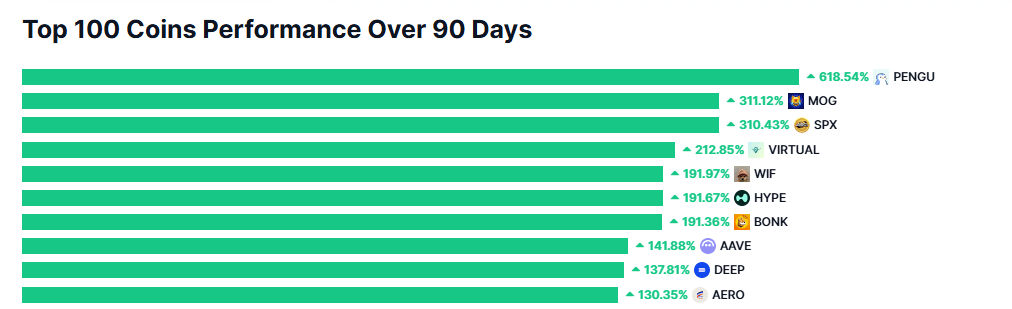

Moreover, memecoins are dominating the “altcoin season” rankings, with SPX climbing to 3rd place with a gain of 295.68% over 90 days.

SPX could reach $2.15 in the coming hours or before the end of the week, according to the 4H MRC. Subsequently, a short-term correction is expected with support at $1.67.

The HTF chart reveals a channel that could offer a peak in the near future at approximately $3.6 for this Ethereum memecoin. This represents almost a 2x increase from its current price. Additionally, the RSI still offers room for further upside.

In the longer term, Murad, a Bitcoin expert and OG, has predicted SPX reaching $100 before the end of the cycle.

This spectacular rise in SPX follows notable accumulation in the spot market. Over the past 24 hours, nearly $1.47 million in additional tokens have been purchased, fueling the bullish momentum.

But that’s not all. Between July 13 and 15, total accumulation on exchange platforms reached $4.99 million, demonstrating sustained investor interest in this token.

On the derivatives market side, the influx of liquidity has been even more significant, reaching approximately 23 times the volume of spot purchases over the same period. The open interest thus jumped by $116.2 million, bringing the total to $226.6 million, representing an increase of 52.24% in just one day.

Despite short-term fluctuations that could affect SPX, the long-term bullish trend seems firmly established. At the time of writing, the index ranks third in CoinMarketCap’s “altcoin season” ranking, with an impressive gain of 295.68% over 90 days.

Interestingly, the top five positions in this ranking are occupied by memecoins, highlighting the strength of this market segment. Although the sector as a whole has recorded “only” 11% growth over the past 7 days, this performance masks the outperformance of major memecoins like SPX.

Although signs of short-term overheating are perceptible, the SPX rally seems far from over. The consolidation around its all-time high levels demonstrates a lasting interest in memecoins, reinforcing confidence in potential for additional growth.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.