What is TheKingfisher ?

TheKingfisher is a specialized crypto trading platform that focuses on market liquidation analysis. Launched as a pioneer of liquidation maps, this solution offers traders insights impossible to obtain elsewhere. The platform positions itself as a true game-changer in the crypto trading universe by revealing hidden market dynamics.

TheKingfisher’s expertise lies in its ability to track and visualize liquidations in real-time on crypto futures markets. This unique approach allows traders to understand where massive liquidation zones are located and anticipate price movements. The platform aggregates data from multiple exchanges to provide a panoramic view of the market.

The TheKingfisher community brings together more than 150,000 active traders who use these tools daily to optimize their strategies. This user base testifies to the effectiveness of the solutions offered and their widespread adoption by trading professionals. More than 80% of members reportedly improve their profitability after integrating these tools into their strategies.

TheKingfisher’s philosophy is summarized by its slogan “Turn volatility into opportunity”. This approach involves using liquidation data to identify zones where the market is likely to react violently. By understanding these mechanics, traders can position their entries and exits more strategically.

TheKingfisher’s Features

Let’s now look at the tools that TheKingfisher offers.

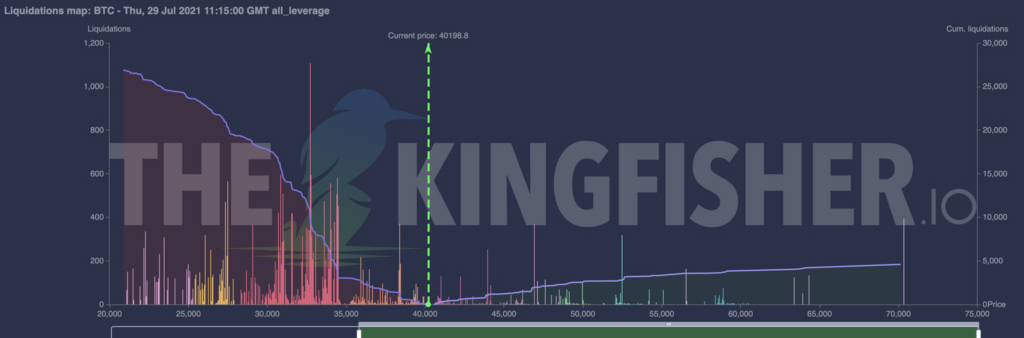

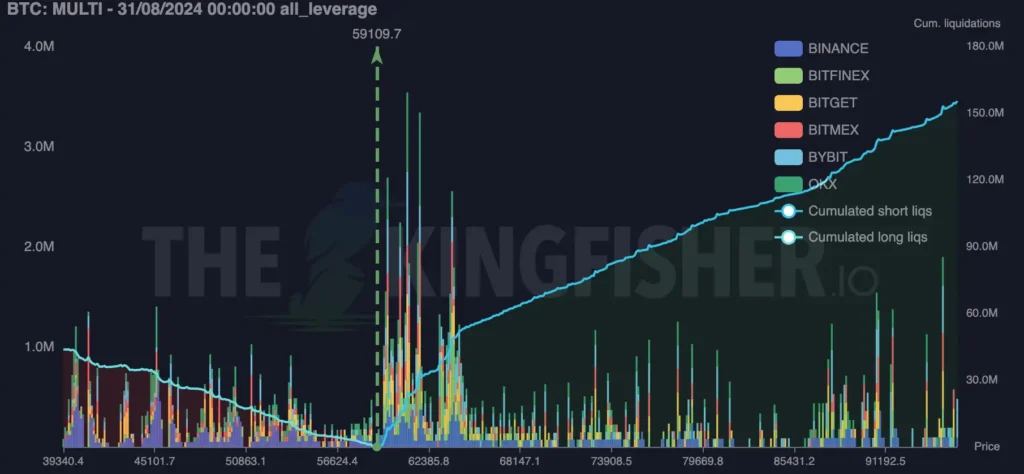

Real-time Liquidation Maps

TheKingfisher’s flagship tool remains its Liquidation Maps which offer precise visualization of levels where leveraged positions risk being liquidated. These maps allow users to instantly identify support zones and resistance created by the accumulation of leveraged positions. This crucial information helps traders anticipate price movements and position their trades accordingly.

The maps aggregate liquidation data from all major crypto exchanges, offering a comprehensive view impossible to obtain by consulting each platform individually. The precision of this data allows traders to differentiate between whale activity (large investors) and retail traders, essential information for understanding the likely direction of the market.

TheKingfisher offers a complete suite of technical analysis tools adapted for crypto trading. The RSI Heatmap allows users to instantly identify cryptocurrencies in oversold or overbought conditions, facilitating the selection of assets to trade. This feature is particularly useful for multi-asset traders who monitor numerous pairs simultaneously.

The Gamma and Vanna analysis provides insights into options dealers’ exposure, revealing hidden buying and selling pressures in the market. These metrics, traditionally reserved for traditional financial markets, bring an additional dimension to crypto analysis by revealing institutional liquidity flows.

Toxic Order Flow Detection

The Toxic Order Flow functionality constitutes a major competitive advantage for TheKingfisher. This tool identifies market manipulations and orders designed to deceive other participants. By detecting these patterns, traders can potentially avoid traps and even profit from the artificial movements created by these manipulations.

This technology analyzes suspicious order patterns and alerts users in real-time when manipulation activities are detected. This early detection capability allows informed traders to position themselves advantageously before the market reacts to the true intentions of manipulators.

Aggregated Orderbook and Depth Analysis

TheKingfisher’s aggregated orderbook compiles market depth data from multiple exchanges, offering a consolidated view of available liquidity. This functionality helps identify price levels where liquidity is concentrated and anticipate natural resistance or support zones.

Depth analysis also reveals imbalances between supply and demand, allowing traders to detect significant accumulations or distributions before they’re reflected in prices. This information is crucial for traders looking to optimize their entry and exit points.

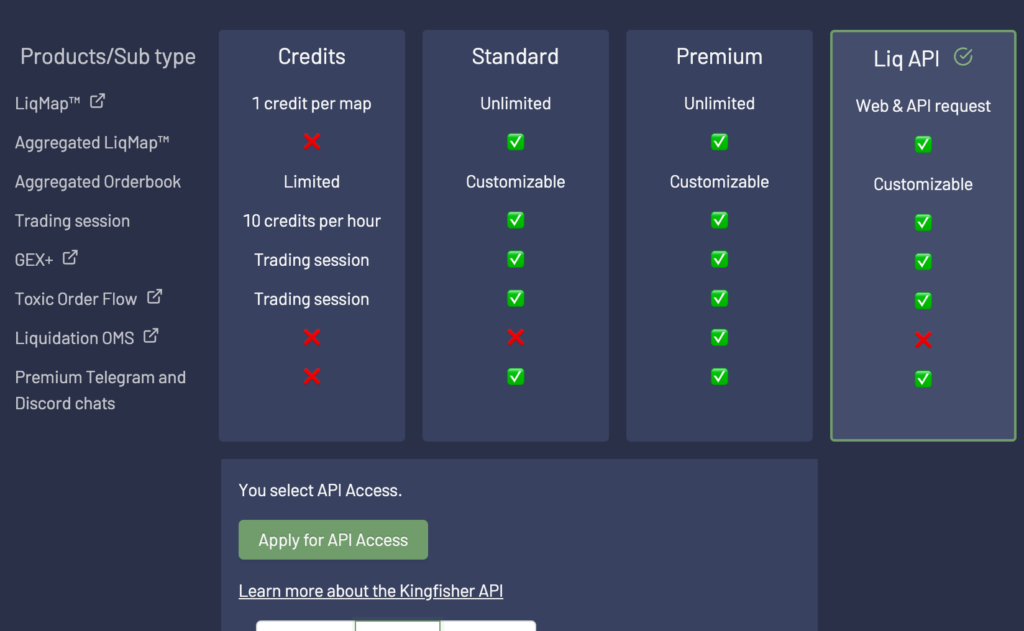

API and Custom Integration

For algorithmic traders and investment funds, TheKingfisher offers a robust API (KF-API) allowing direct integration of liquidation data into their trading systems. This API offers programmatic access to all platform features, enabling complete automation of strategies based on liquidation analysis.

API integration also allows the creation of custom alerts and automatic notification systems when certain liquidation conditions are met. This automation capability is essential for professional traders who manage multiple positions simultaneously.

How to Use TheKingfisher ?

Let’s now see how to use TheKingfisher’s tools.

Getting Started for Beginners

TheKingfisher offers a progressive approach for new users with a free plan including essential features. This trial version includes access to real-time charts with 1 millisecond resolution, daily liquidation maps, and configurable dashboard tools. This approach allows users to become familiar with liquidation concepts without financial commitment.

The intuitive dashboard presents essential information in a clear and organized manner. New users can start by observing liquidation maps to understand how liquidation zones influence price movements. This learning phase is crucial for developing an intuitive understanding of market mechanics.

Using Liquidation Maps

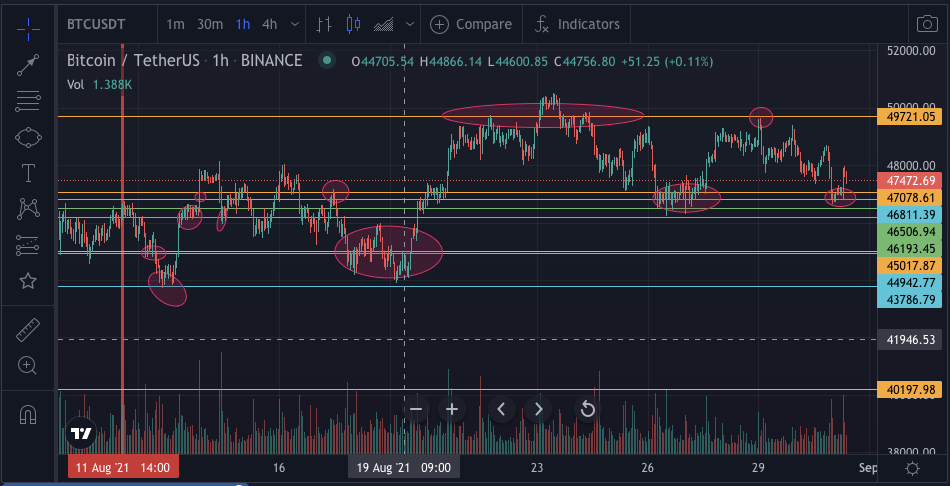

Effective use of liquidation maps requires understanding that areas of high liquidation concentration act as price magnets. When the price approaches these zones, the probability of a violent movement increases significantly. Experienced traders use this information to strategically place their stop-loss and take-profit orders.

Reading the maps also reveals levels where short squeezes or long squeezes are likely to occur. These events create rapid and significant price movements that savvy traders can anticipate and exploit. The key lies in identifying imbalances between long and short liquidations.

Advanced Trading Strategies

Experienced users combine liquidation maps with other indicators to develop sophisticated strategies. Gamma and Vanna analysis helps identify levels where options dealers exert significant influence on prices. This information complements liquidation analysis by revealing institutional forces at work.

Detecting toxic order flows helps avoid false signals and focus on authentic market movements. By filtering out the noise created by manipulations, traders can focus on real opportunities and significantly improve their success rate.

TheKingfisher offers backtesting and performance analysis tools to evaluate the effectiveness of developed strategies. These features allow traders to quantify the impact of using liquidation data on their results. The documented improvement for 80% of users testifies to the effectiveness of this analytical approach.

The platform also encourages the use of its community tools, particularly exclusive Discord and Telegram groups where traders share their analyses and strategies. This collaborative dimension enriches the user experience and accelerates the learning curve for new members.

Advantages and Disadvantages of TheKingfisher

Let’s now examine the platform’s strengths and areas for improvement.

The 5 Main Advantages

- 1. Exclusive data : TheKingfisher offers liquidation insights impossible to obtain elsewhere, with unmatched precision and granularity in the market.

- 2. Active community of 150,000+ traders : Access to an expert community via Discord and Telegram facilitates learning and sharing of advanced strategies.

- 3. Proven performance improvement : More than 80% of users reported improved profitability after integrating the tools into their strategies.

- 4. Comprehensive range of free tools : The free version already offers substantial features allowing users to test the effectiveness of the approach without financial risk.

- 5. API integration for automation : The KF-API allows algorithmic traders to directly integrate data into their automated trading systems.

The 5 Main Limitations

- 1. Significant learning curve : Understanding liquidation mechanics requires time and experience to master effectively.

- 2. High pricing for premium plans : Premium (€65/month) and Pro (€90/month) subscriptions can represent a substantial investment for beginner traders.

- 3. Crypto-exclusive specialization : The platform focuses solely on crypto markets, limiting its usefulness for traditional multi-asset traders.

- 4. Dependence on liquidation data : The effectiveness of strategies relies entirely on the quality and accuracy of the liquidation data provided.

- 5. Technical complexity of advanced tools : Features like Gamma/Vanna analysis require in-depth technical knowledge to be fully exploited.

TheKingfisher stands as a major innovation in the crypto trading ecosystem by democratizing access to liquidation data. The platform fills an important gap by making market mechanics traditionally reserved for financial institutions visible.

The value for money is justified for active traders generating significant volume. The Premium subscription at €65 per month can quickly pay for itself through improved trading performance. For professionals, API access at €500 per instrument represents a strategic investment for automating sophisticated strategies.

TheKingfisher primarily addresses experienced crypto traders looking to refine their strategies with exclusive data. The platform excels in identifying opportunities for short-term trading and optimizing entry and exit points. The continuous evolution of tools and expansion of the community promise to further strengthen the value proposition of this innovative solution.