Why is the Crypto market crashing today?

Bitcoin drops below $70k! Discover the key reasons behind today's crypto market correction, including macro factors and market analysis.

Bitcoin drops below $70k! Discover the key reasons behind today's crypto market correction, including macro factors and market analysis.

The current crash is not an isolated event specific to crypto, but the direct consequence of a risk-off sentiment dominating global finance. Investors are abandoning volatile assets to seek refuge in cash, propelling the dollar index (DXY) to new highs.

The main catalyst for this fear is the return of hawks to the Federal Reserve. Rumors surrounding Kevin Warsh’s nomination and a more restrictive monetary policy (“Hawkish”) have dampened hopes of an imminent rate cut. In an environment of high rates, liquidity becomes scarce, and Bitcoin is often the first to pay the price.

Adding to this is a layer of geopolitical tension. Recent escalations between the United States and Iran have created massive uncertainty in the markets. Unlike gold, a historical safe haven, Bitcoin still reacts like a high-risk asset during the initial phases of crisis. This explosive cocktail has triggered an immediate correction, erasing gains from recent weeks.

As often happens, when Bitcoin sneezes, altcoins catch pneumonia. Ethereum (ETH), Solana (SOL) and XRP are showing significant losses, with traders looking to secure their positions in stablecoins. However, amid this sea of red, one token stands out with brazen performance: MYX Finance (MYX).

Why is MYX outperforming? MYX Finance is a decentralized exchange protocol (DEX) specialized in perpetual contracts. Its Matching Pool Mechanism (MPM) technology enables slippage-free trading, a key advantage during periods of high volatility. Ironically, it’s during crashes that these platforms see their volume explode. Traders rush to short the market or hedge their positions.

This resilience of MYX illustrates a strategic capital rotation. Investors are not leaving the crypto ecosystem, but moving their liquidity toward protocols generating Real Yield, directly benefiting from volumes and volatility, even during Bear market phases.

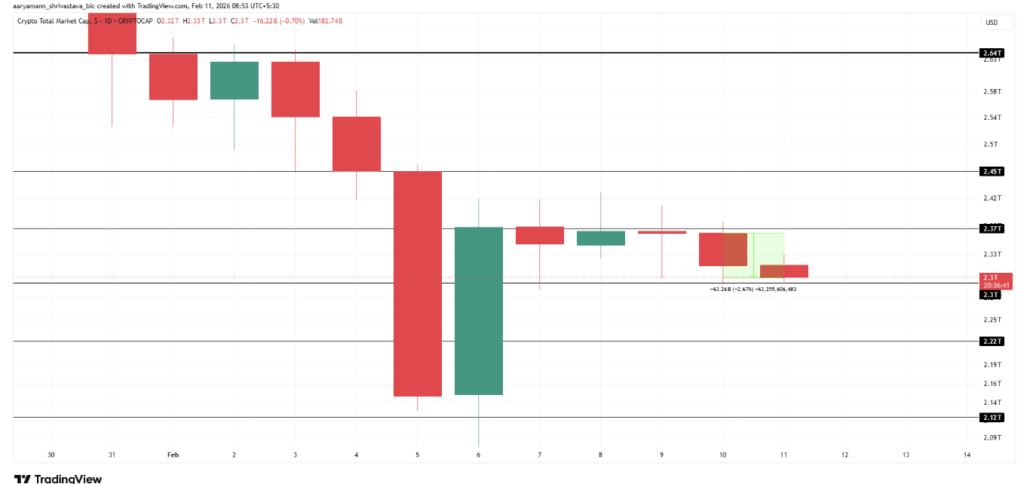

From a technical perspective, losing the $70,000 level is a serious warning signal. This level, which acted as robust support, has transformed into resistance. On-chain data reveals that over $800 million in long positions have been liquidated in 24 hours, creating a snowball effect that accelerates the price decline.

Outflows from Spot Bitcoin ETFs, notably those from BlackRock, confirm that institutions are reducing their exposure. If buyers fail to defend the $68,000 zone, the next logical stop sits around $60,000 – $62,000, a historical demand zone where “whales” might start accumulating again.

The burning question on every investor’s mind is now: are we witnessing a simple leverage purge before a bullish recovery, or is this the beginning of a deeper crypto winter? The price reaction at current support levels over the next 48 hours will be decisive for the rest of the cycle.

👉 Join our free private group and benefit from a pro trader’s trades to generate profits all year long.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.