What is JLP ?

JLP (Jupiter Liquidity Provider Token) represents a major innovation in the world of decentralized finance on Solana. Unlike traditional tokens, JLP functions as a liquidity token that provides access to a proportional share of the liquidity pool powering Jupiter Perps, the perpetual trading platform within the Jupiter ecosystem.

This sophisticated token constitutes a diversified index of assets meticulously designed to optimize swaps and leveraged trading. Indeed, the JLP pool aggregates five major assets: SOL, ETH, WBTC, USDC and USDT.

JLP’s architecture is based on an automated counterparty mechanism where the pool acts as a direct counterparty to traders using Jupiter Perps. When traders open leveraged positions, they borrow tokens directly from the JLP pool, generating fees that are redistributed to token holders.

This unique approach allows JLP holders to benefit from both the appreciation of the pool’s assets and the revenue generated by perpetual trading activity.

The History of JLP

The history of JLP is inseparable from that of Jupiter Exchange, launched in October 2021 by co-founders “Meow” and Ben Chow. Initially designed as a simple DEX aggregator, Jupiter quickly evolved towards a more ambitious vision of creating the “best decentralized trading experience on Solana”.

The development of Jupiter Perps and the JLP token is part of this expansion strategy towards a “DeFi super app”. Jupiter’s team identified the growing need for decentralized perpetual trading solutions offering a credible alternative to traditional centralized platforms.

The launch of JLP marks a strategic turning point for Jupiter, transforming the platform from a simple aggregator into an integrated financial ecosystem. This evolution builds on the technical expertise acquired in liquidity aggregation and deep understanding of Solana traders’ needs.

JLP’s main innovation lies in its unified liquidity pool approach that eliminates the liquidity fragmentation problems typical of traditional AMMs. This architecture allows for reduced spreads and optimized execution for perpetual positions.

Who Created JLP ?

The primary creator of JLP is “Meow”, the pseudonymous founder of Jupiter Exchange who has built one of the most active and engaged communities in the crypto ecosystem. Meow embodies a transparent and community-focused approach to development, maintaining regular communication with users through social networks and AMAs.

Ben Chow, Jupiter’s co-founder, brings the technical expertise necessary for developing the complex protocols underlying JLP. This collaboration between strategic vision and technical excellence explains the remarkable success of the Jupiter ecosystem.

The Jupiter team recently strengthened its capabilities through the acquisition of Ultimate Wallet and Moonshot, demonstrating an aggressive expansion strategy aimed at creating a complete DeFi ecosystem. These acquisitions bring additional talent and complementary technologies to JLP’s development.

What is JLP Crypto Used For ?

JLP transcends the status of a simple liquidity token to become a true sophisticated financial instrument offering multiple use cases in the Solana ecosystem. Its primary function is to provide the necessary liquidity for Jupiter Perps to operate, but its applications extend far beyond.

JLP’s primary use case lies in passive income generation for its holders. By participating in the liquidity pool, investors receive 75% of the fees generated by perpetual trading activity, creating a revenue stream directly correlated to the platform’s activity volume.

JLP also functions as a diversified investment product offering balanced exposure to major crypto market assets. This automatic diversification eliminates the need to individually manage multiple positions, simplifying users’ investment strategy.

In the realm of advanced trading, JLP enables the implementation of sophisticated strategies such as delta neutral, where investors can hedge their exposure while retaining liquidity revenues. These strategies attract institutional investors seeking returns uncorrelated with market movements.

JLP’s use extends to lending protocols with the recent launch of Fluid, allowing holders to use their tokens as collateral to borrow other assets. This functionality increases capital efficiency and opens new arbitrage opportunities.

Which Network Does JLP Run On ?

JLP operates exclusively on the blockchain Solana, thus inheriting all the technical characteristics that make this blockchain one of the most performant in the crypto ecosystem. This native integration with Solana allows JLP to benefit from near-instantaneous transaction times and negligible fees.

Solana’s architecture is based on technical innovations such as Proof of History and Gulf Stream, allowing it to process up to 65,000 transactions per second. This exceptional performance is crucial for JLP, which must handle a significant volume of transactions related to perpetual trading and liquidity adjustments.

Solana’s position as a reference blockchain for high-performance DeFi favorably positions JLP to capture future growth in the sector. The ecosystem continues to attract new projects and users, creating a beneficial network effect for all native tokens like JLP.

Advantages and Disadvantages of JLP

Let’s now discuss the strengths and areas for improvement of the JLP token.

Advantages

- Attractive Yield : JLP offers a 20.53% APY based on actual trading fees, creating a predictable and less volatile passive income stream than traditional farming yields.

- Automatic Diversification : The token exposes investors to a balanced basket of major assets (SOL, ETH, WBTC, USDC, USDT) without requiring active portfolio management.

- Institutional Liquidity : With over $1.6 billion in TVL, JLP benefits from deep liquidity facilitating significant position entries and exits without significant price impact.

- Technical Innovation : The Jupiter team continuously develops new features such as delta neutral strategies and integration with lending protocols.

- Expanding Ecosystem : Jupiter is evolving towards a DeFi super app with strategic acquisitions and new products, increasing JLP’s utility value.

Disadvantages

- Counterparty Risk : As a counterparty to perpetual traders, the JLP pool can suffer losses during unfavorable market movements or massive winning trades.

- Technical Complexity : The pricing mechanism and profit/loss redistribution can be difficult for novice investors to understand, creating risks of misvaluation.

- Dependency on Jupiter : JLP’s value is entirely linked to the success of the Jupiter Perps platform, creating a concentration risk on a single protocol.

- Underlying Asset Volatility : Despite diversification, JLP remains exposed to price movements of major cryptocurrencies, which are particularly volatile.

- Regulatory Risks : Evolving regulations on crypto derivatives could affect the operation of Jupiter Perps and JLP’s value.

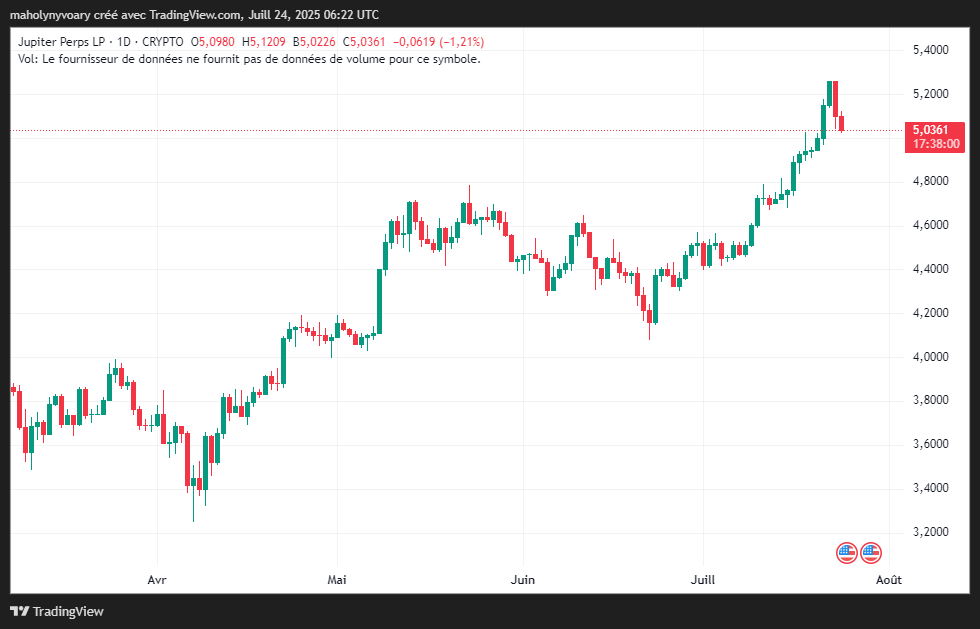

JLP Price and Predictions

Currently valued at approximately $5.23, the JLP token has demonstrated remarkable resilience in recent months, with a stable market capitalization around $1.6 billion.

The price evolution of JLP follows a different logic from traditional tokens, being determined by the value of the pool’s assets and trading profits and losses. This valuation method offers complete transparency and eliminates speculative distortions in the crypto market.

The token reached its all-time high of $5.27 on July 23, 2025, demonstrating growing investor confidence in Jupiter Perps’ business model. Daily trading volumes range between $60 and $100 million, testifying to equally robust liquidity.

Predictions for 2025

Analysts predict a mixed 2025 for JLP, with predictions varying according to Jupiter Perps adoption scenarios. Conservative projections anticipate a range of $3.40 to $6.24, reflecting a possible consolidation after the rapid growth of 2024 and 2025.

Some more pessimistic predictions call for a decline of about 20% to reach $4.17 by August 2025, incorporating the risks of slowing DeFi activity and increased competition in the perpetuals sector.

Predictions from 2026 to 2030

In the medium term, JLP’s outlook is based on the maturation of the Jupiter ecosystem and the expansion of decentralized perpetual trading. For 2026, experts anticipate a range of $3.74 to $7.16, with an average price of $5.09 based on 5% annual growth.

The 2030 horizon opens more ambitious perspectives, with a maximum potential of $30.948 according to the most optimistic projections. These predictions are based on the assumption of massive adoption of decentralized perpetual trading and significant expansion of the Jupiter ecosystem.

It’s worth noting that these predictions remain highly speculative and depend on many unpredictable factors, including technological evolution, competition, and the regulatory environment.

Important Moments in JLP’s History

Let’s now look at the moments that have shaped the history of the JLP token.

2021 : Jupiter’s Foundations

October 2021 marks the birth of Jupiter Exchange by “Meow” and Ben Chow, laying the technological foundations that would later enable JLP’s development. This period saw Jupiter establish itself as the reference DEX aggregator on Solana, creating the expertise necessary for more complex products.

2022-2023 : Development and Maturation

2022 saw Jupiter consolidate its position as a leading aggregator while developing perpetual products. The team refined its understanding of market needs and developed the liquidity management algorithms that would power JLP.

2024 : Launch of Jupiter Perps and JLP

2024 marks the official launch of Jupiter Perps and the JLP token, transforming Jupiter from a simple aggregator into a complete perpetual trading platform. This year saw the strategic acquisitions of Ultimate Wallet and Moonshot, strengthening the ecosystem.

2025 : Expansion and Innovation

2025 confirms JLP’s maturity with the launch of the Fluid lending protocol allowing JLP to be used as collateral. Jupiter also announces an allocation of 150 million USDC to strengthen liquidity, demonstrating long-term commitment to the product.

How and Where to Buy JLP ?

JLP acquisition is exclusively done on Jupiter Exchange, the native platform that hosts this unique liquidity token. Here is a detailed guide to buy JLP safely.

Step 1: Prepare your Solana wallet

Download and configure a Solana-compatible wallet like Phantom or Solflare. Create your wallet by carefully saving your 12-word recovery phrase in a safe place. Make sure you have SOL in your wallet to cover transaction fees (about 0.01 SOL is sufficient).

Step 2: Get SOL

Buy SOL on a centralized exchange like Bitget, then transfer them to your Solana wallet. Alternatively, use the direct crypto purchase function in Phantom with your bank card. Verify that you have the desired amount in SOL for your JLP investment.

Step 3: Access Jupiter Exchange

Go to jup.ag and connect your wallet by clicking “Connect Wallet” in the top right. Select your wallet (Phantom, Solflare, etc.) and authorize the connection. Verify that the displayed address matches your wallet.

Step 4: Navigate to the JLP section

In Jupiter’s main menu, click on “JLP” or go directly to the dedicated page. You then access the Jupiter Liquidity Provider token management interface with buy and sell options clearly displayed.

Step 5: Make the JLP purchase

Click on “Buy JLP” and enter the amount of SOL you want to convert to JLP. The interface automatically displays the number of JLP tokens you will receive and the current APY. Check the transaction details and click “Confirm” to validate.

Step 6: Confirm the transaction

Your wallet will display a confirmation popup with transaction fees. Click “Approve” to finalize the purchase. The transaction is usually confirmed within seconds on Solana. Your JLP tokens appear immediately in your wallet and start generating revenue.

How to Store Your JLP ?

Once you’ve acquired JLP tokens, the question of their secure storage becomes paramount. Leaving your cryptocurrencies on an exchange platform (CEX) carries significant risks: you don’t directly control your private keys, and your funds could be lost in case of platform hacking, regulatory issues, or company bankruptcy.

That’s why it’s strongly recommended to transfer your JLP to a personal wallet where you alone hold the private keys. “Not your keys, not your coins” is a fundamental adage in the crypto ecosystem.

There are mainly two types of wallets for storing your JLP :

- Cold Wallets : These are hardware devices that store your private keys offline, thus offering the highest level of security against online hacking. They often resemble secure USB keys. Well-known brands such as Ledger (for example, Ledger Nano S Plus or Ledger Nano X) are the safest solutions for storing significant amounts or for long-term storage.

- Hot Wallets : These are software applications (mobile or desktop apps, browser extensions) that store your private keys on a device connected to the Internet. They are more convenient for frequent use and for interacting with decentralized applications (dApps), but are inherently more vulnerable to malware and phishing than cold wallets. Popular wallets like MetaMask or Trust Wallet can be configured to manage JLP tokens.

The choice between a cold wallet and a hot wallet depends on your specific needs: opt for a cold wallet (like Ledger) for maximum security of your main investments, and possibly use a hot wallet (like MetaMask or Trust Wallet) for smaller amounts intended for regular interactions with Jupiter’s and Solana’s DeFi ecosystem. The essential thing is to always carefully secure your recovery phrase (seed phrase) and never share it or store it digitally.

How to Get JLP for Free ?

Obtaining JLP for free remains possible thanks to several mechanisms set up by the Jupiter ecosystem and its partners. These opportunities allow new users to discover the token without significant initial investment.

Jupiter reward programs occasionally include distributions of JLP to reward community engagement and active use of the platform. These events are announced on official social networks and generally require specific actions such as participation in governance votes.

Some partner protocols offer cross-airdrops where active users of the Solana ecosystem can receive free tokens. These distributions generally target Jupiter token (JUP) holders or frequent users of Jupiter Exchange.

Yield farming strategies on third-party protocols may include JLP as a reward, allowing users to earn the token by providing liquidity or staking other assets. It’s advisable to verify the legitimacy of these programs before participating.

It’s crucial to remain vigilant against false promises of free airdrops that proliferate on social networks. Legitimate distributions never ask you to send funds in advance or communicate private keys.

Is JLP Legal ?

The legality of JLP primarily depends on the user’s jurisdiction of residence and the regulatory framework applicable to decentralized financial products. In most cases, JLP is legal to hold and exchange, but certain nuances deserve attention.

JLP enjoys a favorable legal status in most developed jurisdictions. In Europe, the token is considered a digital asset under the MiCA regulatory framework, which harmonizes crypto regulation at the European level. Its nature as a liquidity token generally classifies it as a financial instrument rather than a security.

In the United States, this token is also not classified as a security by the SEC, functioning as a utility token with concrete use cases. This classification facilitates its trading and holding for American investors.

Holding the token generates tax obligations in most countries. In France, income generated by JLP (APY) is taxed as investment income, while capital gains follow the cryptocurrency regime with a 30% tax rate.

Some countries maintain restrictions on crypto derivative products, which may affect the use of JLP. It is recommended to consult a local tax advisor to understand the specific implications for each jurisdiction.

Who Holds the Most JLP ?

The distribution of holders of the token reveals a relatively balanced ownership structure, favored by the institutional nature of the token and its use in sophisticated investment strategies. This distribution reflects adoption by professional investors and DeFi protocols.

The largest holders of the token primarily include crypto investment funds specializing in DeFi and protocols using JLP as collateral or liquidity reserve. These institutional investors bring additional stability and credibility to the token.

Yield farming protocols and lending platforms also hold significant quantities of JLP, using it as an underlying asset for their financial products. This institutional use creates structural demand for the token.

The transparency of the Solana blockchain allows real-time monitoring of token distribution, offering investors complete visibility on large holder movements and concentration trends.

The crypto positions itself in 2026 as a mature and sophisticated financial product that has managed to move beyond the experimental stage to become a credible investment instrument. Our analysis reveals a token that intelligently combines diversified exposure and income generation, creating a unique value proposition for investors.

The fundamentals of JLP are solid, benefiting from the continued growth of Jupiter Exchange and the increasing adoption of decentralized perpetual trading. Then, the continuous innovation of the Jupiter team, illustrated by the launch of Fluid and delta neutral strategies, demonstrates an ability to adapt and evolve that strengthens JLP’s long-term value.

However, the inherent risks of perpetual trading and concentration on the Jupiter ecosystem require a cautious approach. Our perspective remains moderately optimistic, conditioned by Jupiter’s ability to maintain its dominant position in the face of growing competition in the decentralized perpetuals sector.